Proven Techniques for Effectively Managing Debt During Furlough

Proven Techniques for Effectively Managing Debt During Furlough

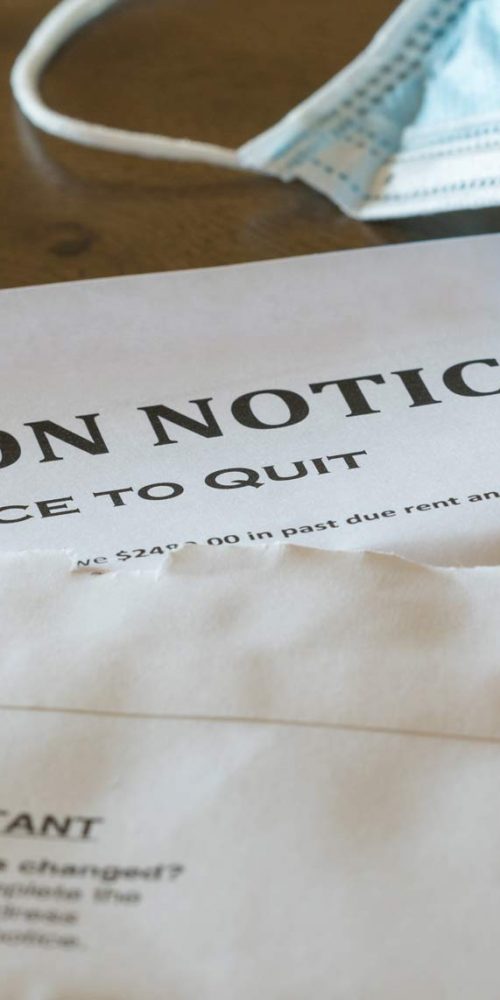

The COVID-19 pandemic has profoundly affected the UK economy, leading to widespread furloughs and layoffs across numerous sectors. As a result, many individuals are grappling with financial hardships and the anxiety of handling their existing debts amidst dwindling income levels. If you are among those facing prolonged furlough, managing your debts can appear overwhelming, particularly when your income is reduced to 80% of your typical salary. However, navigating this challenging financial terrain is entirely achievable by implementing effective strategies aimed at managing and reducing your debt burden. Here’s how you can take proactive steps to regain control of your financial future during these unprecedented times.

1. Develop a Tailored Monthly Budget Reflecting Your Current Income

Start by crafting a revised monthly budget that accurately reflects your current financial circumstances. This budget should be based on your reduced income while also highlighting your potential for savings. Evaluate your spending habits critically and consider reallocating funds from discretionary expenses, such as entertainment, dining out, and luxury purchases, towards your essential bills and savings. By focusing on your financial obligations and minimizing non-essential spending, you can create a sustainable budget that enables you to manage your debts more effectively while also safeguarding against future financial uncertainties.

2. Explore Additional Income Sources to Compensate for Reduced Salary

To meet your debt repayment responsibilities, it’s crucial to identify ways to offset the 20% salary reduction. Look into alternative income avenues, such as freelance opportunities or part-time employment, and consider trimming your expenses by canceling rarely used subscriptions or reassessing your grocery shopping habits. Implementing a budget-friendly meal plan can significantly reduce your monthly outlays. By actively pursuing these extra income sources and savings, you’ll be better positioned to meet your debt obligations and avoid falling behind during your furlough period.

3. Consider Debt Consolidation Loans to Streamline Your Payments

Explore the option of applying for debt consolidation loans for bad credit. These financial tools can simplify your financial responsibilities by consolidating multiple debts into a single, manageable monthly payment. This solution can help eliminate confusion surrounding various due dates and payment amounts, making financial planning more straightforward. For individuals on furlough, a <a href="https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/">debt consolidation loan</a> can provide a structured approach to managing a limited income while alleviating the stress associated with handling multiple payments, ultimately assisting you in regaining your financial stability.

4. Strategically Plan for Your Long-Term Financial Goals

As you navigate your current financial situation, take time to reflect on your long-term aspirations, such as buying a home or launching a business. Setting these ambitious goals can inspire you to enhance your financial status. A debt consolidation loan can also play a vital role in improving your credit score, making it easier for you to obtain a mortgage or business loan with attractive interest rates. By planning with intention and striving towards your financial objectives, you can establish a pathway to success and achieve greater financial independence over time.

For further assistance and strategies on managing your finances during the pandemic, and to learn more about how <a href="https://limitsofstrategy.com/understanding-good-debt-and-bad-debt-a-clear-guide/">debt consolidation loans</a> can support furloughed employees, reach out to Debt Consolidation Loans today.

If you are a homeowner or business owner, connect with the experts at Debt Consolidation Loans today to discover how a debt consolidation loan can significantly enhance your financial health and stability.

If you believe a Debt Consolidation Loan aligns with your financial goals, do not hesitate to contact us or call 0333 577 5626. Take the essential first step towards improving your financial situation with manageable monthly repayments.

Discover Valuable Financial Resources for Expert Insights:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Can You Successfully Consolidate Your Medical Loan?

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Postponed Until March: Key Information to Know

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Proven Strategies for Rapidly Getting Out of Debt

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Comprehensive Guide to the Pros and Cons of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Maximize Your Financial Planning with Our Debt Consolidation Loan Calculator

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On https://limitsofstrategy.com